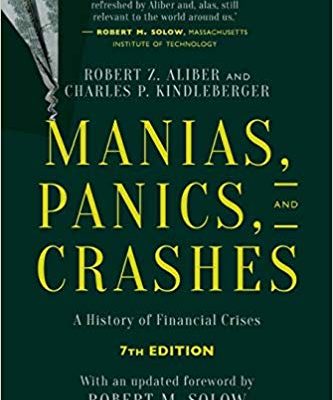

Review Manias, Panics, and Crashes: A History of Financial Crises

by ROBERT Z. ALIBER, CHARLES P. KINDLEBERGER

Description

To state, the very obvious, failure, crises, and speculative excess are ever-present in the finance system. This statement can be gleaned ever since the dawn of the financial system’s becoming a persistent decline, and mishaps continue to invade the sensitive landscape.

Manias, Panics, and Crashes came to be the most popular and the most accurate book accounting for the history of the financial system and the pitfalls it previously met. The debut of this book back in 1978 was meant to observe, analyze, and follow the financial markets. As this became the mission, it also started to carry out a single logic that the highly-volatile financial structure and nature are unpredictable since markets constantly rise and fall, increase and decrease, swell and deplete. The author revealed that the overall framework is an interweaving fabric of recurring patterns as he put emphasis that crises and setbacks conform to a rhythmic structure, warning that the previous crises may persist in the future.

The newly updated and revised edition of this financial history classic highlights and probes the latest declines and disasters in the world of finance. It covers the financial hardships that surfaced in the East Asian region and the ramifications of the Mexican crisis to the 1992 Sterling downfall. More so, the exposition of history brings out questions that need immediate answers.

About the Authors

Charles Kindleberger was an economic and financial historian to which the majority of his published works center on the narration of the overall financial system history. He published 30 books, and one of the most commendable contributions to financial literature is his 1978 Manias, Panics, and Crashes. Kindleberger is also a popular proponent of the hegemonic stability theory and has been regarded as the “Master of the Genre” on the financial crises.

Robert Aliber is Professor Emeritus of International Economics and Finance at the University of Chicago Booth School of Business, USA. He was director of the Center for Studies in International Finance. He was part of the research staff for the Committee for Economic Development and Commission on Money and Credit. He served as a senior economic advisor for the Agency for Economic Development, US Department of State.

Table of Contents

List of Tables

Foreword by Robert M. Solow

Introduction

- Chapter 1: Financial Crises: A Hardy Perennial

- Chapter 2: The Anatomy of Financial Crisis

- Chapter 3: Speculative Manias

- Chapter 4: Fueling the Flames: The Expansion of Credit

- Chapter 5: The Critical Stage- When the Bubble Is About to Pop

- Chapter 6: Euphoria and Paper Wealth

- Chapter 7: Bernie Madoff: Frauds, Swindles, and the Credit Cycle

- Chapter 8: International Contagion 1618-1930

- Chapter 9: Bubble Contagion: Mexico City to Tokyo to Bangkok to New York, London, Reykjavik

- Chapter 10: Euromania and Eurocrash

- Chapter 11: Policy Responses: Benign Neglect, Exhortation, and Bank Holidays

- Chapter 12: The Domestic Lender of Last Resort

- Chapter 13: The International Lender of Last Resort

- Chapter 14: The Lehman Panic- An Avoidable Crash

- Chapter 15: The Lessons of History

Epilogue

Notes

Afterword by Lord Robert Skidelsky

Index