Swing trading is a trading method that attempts to make profits from stocks within a certain period of days to weeks. Simply put, a trader is looking for a single move or a swing while monitoring the market to exit trading before potential pressure surfaces occur.

The prerequisite of swing trading is to maintain the trades for a longer period of time; for longer than one day, which usually lasts up to weeks. However, this definition replaces what swing trading actually is. In reality, swing trading includes daytime and trend trading, as swing traders have the ability to hold a stock for a certain period (days to weeks) as they make their position highly dependent on fluctuations within the week.

SELECTION OF RENTABLES SHARES IN SWING TRADING

One of the most important factors to ensure success in swing trading is the type of swing trading stocks you will choose. In this case, high-market stocks are a good choice, as they are considered the most common and most active stocks traded on major exchanges. In a market environment, large-cap stocks have a high probability of swinging between the highs and lows at the same time, as swing traders follow a certain price movement for days and only switch for their counterpart when the price reverses.

USE OF SWING TRADING STRATEGIES

Below are some swing trading strategies that are guaranteed to achieve exponential success in swing trading. Although there are many ways to perform swing trading, the following strategies are proven and tested.

- BREAKOUTS – this type of swing trading technique uses the early minutes of an uptrend when it comes to placing a trade. Once a stock has reached a certain level of movement and volatility, breaking through important support or resistance points, it is ideal to place a trade.

- BREAKDOWNS – this is known to be the counterpart to the breakout technique, while the prerequisite for this is the opposite of the latter. As soon as the share price approaches a certain level of support, it is ideal to place a trade.

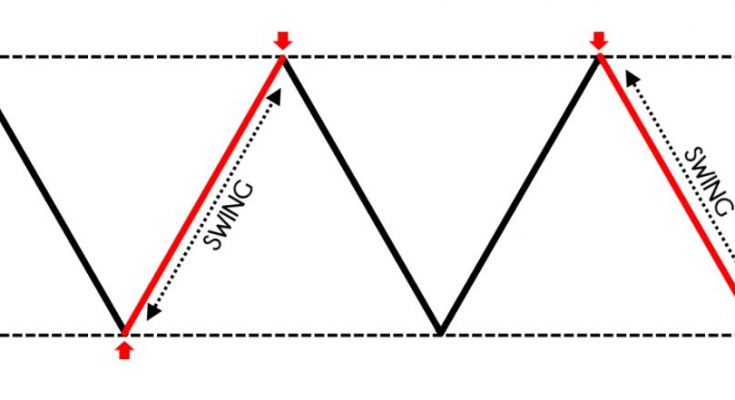

- SWING HIGH AND SWING LOW – this swing trading technique reveals important market information. The formation of a swing high is confirmed as soon as a third high is reached after two consecutive lower heights. In addition, a swing low is confirmed when a price drops after two consecutive higher lows.

Benefit

A swing trader should note that it is crucial to close a trade neutral enough to overrule or undercontrol the channel without great accuracy. Precise action can lead to too much risk and, for example, loss of a potential trading opportunity. When pushing the market with stocks, if you want to be in a sustained trend direction, it is important for a swing trader to wait until the channel line is reached before they get any profits.

Conclusion

Swing trading developed into an ideal trading style that suits beginners. In line with it, it also offers profit opportunities for beginners. It allows traders to achieve reasonable returns after days of monitoring and trading with swings. However, swing trading is only suitable for traders who know how to track weekly and monthly market trends.